Buying a home and investing in Real Estate is a major endeavor that can yield deep and lasting rewards. Today Real Estate transactions usually exceed $100,000. The seller is usually represented by a listing agent who looks out for their best interests. As a buyer you need someone who understands your perspectives and is committed to helping you achieve a successful transaction.

There are many good reasons to work with a qualified real estate professional—especially a trained professional who has earned the Accredited Buyer’s Representative (ABR®) designation, representing best-in-class buyer services. You’ll be working with someone who has gone the extra mile by completing specialized training in delivering the best in buyer-representation services. Plus, a REALTOR® who has an ABR® Designation also has an established track record, with proven experience in representing the concerns of home buyers.

Our services are FREE to home buyers!

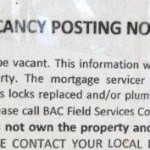

Foreclosures are a niche market with many subtle but important nuances, requiring considerable specialized knowledge, experience and contacts. If you decide to pursue a foreclosure purchase, you’ll want to work with Bill Edge an Affordable Housing Specialist who can educate you on the process. He can help you crunch the numbers, determine a logical purchase plan, avoid potential set-backs, and assist you with all the unique processes and paperwork involved with foreclosures.

You can, and should, get pre-approved for a home loan before you go looking for a home

Pre-approval is easy, and can give you complete peace-of-mind when shopping for your home. Mortgage experts can obtain written pre-approval for you at no cost and no obligation, and it can all be done quite easily over-the-phone. More than just a verbal approval from your lending institution, a written pre-approval is as good as money in the bank. It entails a completed credit application, and a certificate which guarantees you a mortgage to the specified level when you find the home you’re looking for. Consider dealing only with a professional who specializes in mortgages. Enlisting their services can make the difference between obtaining a mortgage, and being stuck in the renter’s rut forever. Typically there is no cost or obligation to enquire.

Buyers can get into a home even if you don’t have a down payment!

No Down Option #1 – $100 HUD Down Payment

$100 down payments on HUD Homes financed with FHA-insured financing

No Down Option #2-Houston Assistance Program

First time buyers can get up to $19,500 in down payment if their gross family income is at or below 80% of the area median.

No Down Option #3– Gift Funds

The “tax credit advance” may also be possible with the help of the buyers employer and/or relative(s).

No Down Option #4– Eligible Vets

Eligible veterans can use a VA loan to buy a home with no money down.

No Down Option #5– USDA

Qualifying borrower’s living outside of major urban areas may qualify for USDA zero down financing

No Down Option #6-Harris County Assistance Program

First time buyers can get up to $14,200 for new construction, $9,500 for resale properties, built within the current ten (10) years. You must live in the house for five (5) years, which is the affordability period.

Be the first to know about Hot New Listings

Our Exclusive Buyer Profile System saves you Time and Money. Simply enter your criteria into our on line form and get priority access to ALL homes that match your criteria, including Bank Foreclosures, Company Owned Properties and other Distress Sales.

No more wasted time looking at out-dated information in newspapers or searching the internet. Priority access means you’re there first before other buyers, so you can negotiate the lowest possible price and your time is not wasted viewing homes that don’t interest you.

Click here to be auto-notified!

Call Bill Edge at 713-240-2949 to see Houston homes in 24 hours or less.